KEY TAKEAWAYS

- The Myth of “Free”: Having insurance doesn’t mean surgery is free. Deductibles and copays often exceed $6,000.

- The “Surprise Bill”: US hospitals often charge separate fees for the surgeon, anesthesiologist, and facility, leading to unexpected debt.

- The All-Inclusive Certainty: Dr. Gabriela’s package includes everything—no hidden fees, no surprises.

- Speed is Savings: Skipping the 6-month insurance waiting period saves you money on food, medications, and lost time.

The Letter You Dreaded: “Approved, But…”

You finally got the approval letter from your insurance company. You are excited. You think the battle is over. Then, you look at the estimated “patient responsibility” breakdown.

- Deductible: $5,000

- Co-Insurance: 20%

- Out-of-Network Anesthesiology: Not covered.

Suddenly, your “covered” surgery has a price tag that rivals the cost of a used car.

In my 15+ years of practice as a Double Board-Certified surgeon, I have seen countless patients abandon their health goals simply because the “covered” route was too expensive. They assume that if they can’t afford the insurance deductible, they certainly can’t afford “private” surgery.

This is a mathematical error.

In reality, flying to Tijuana for a VIP, all-inclusive experience with me is often cheaper than the out-of-pocket costs of using your own US insurance plan. Let’s break down the numbers, the hidden fees, and the value proposition.

The Hidden Costs of US Healthcare: A Breakdown

In the United States, pricing is opaque. You never know the true cost until weeks after the surgery.

1. The Deductible Barrier

Most affordable US insurance plans (Bronze/Silver tiers) have high deductibles. You must pay the first $4,000 to $7,000 of your medical bills every year before coverage kicks in.

- Reality Check: If my full surgical package is approx. $5,800 USD, you are often paying less than your deductible alone.

2. The “Co-Insurance” Kicker

Even after you hit your deductible, many plans charge “Co-Insurance” (usually 20%).

- A typical US hospital bill for a gastric sleeve is $30,000 – $40,000.

- 20% of $40,000 is $8,000.

- Combined with your deductible, your total responsibility could easily hit $10,000+.

3. The “Surprise” Bills

In US hospitals, the surgeon might be “In-Network,” but the Anesthesiologist or the Surgical Assistant might be “Out-of-Network.” You won’t know this until you receive a separate bill for $2,000 in the mail three weeks later.

The Dr. Gabriela “No-Surprise” Model

In Tijuana, we operate differently. We believe in transparency. When I quote you a price for my Enhanced Gastric Sleeve, that number is final.

My Average Package Price: ~$5,000 – $6,500 USD (Depending on BMI/History).

What This Single Price Includes:

- Surgeon Fees: For a Master Surgeon of Excellence (Me).

- Anesthesiologist Fees: For a Board-Certified MD (Never a nurse).

- Hospital Fees: 2 nights in a AAAASF (QUAD A) accredited surgical center.

- implants & Supplies: Premium staples (Covidien/J&J) and Seamguard reinforcement.

- Medication: All post-op antibiotics and pain management for your stay.

- Logistics: Private driver (San Diego to Tijuana roundtrip) and a recovery hotel stay.

- Nutrition: Pre-op and post-op nutritional guidance.

What You Pay Extra: Nothing. Just your flight to San Diego.

Why “Cheap” Surgery is Expensive, but “Value” is Smart

I need to address the elephant in the room. You will find clinics in Tijuana offering surgery for $3,500 or $3,999.

Please, run away from these offers.

To offer surgery at that price, corners must be cut. In my medical opinion, these “bargain” clinics often compromise on the very things that keep you safe:

- Anesthesia: They use uncertified technicians instead of MDs.

- Staples: They may buy “gray market” or expired surgical staplers.

- Volume: They force surgeons to operate on 8-10 patients a day.

I position my practice in the “Value Tier.” I am not the cheapest, but I am significantly more affordable than the US while maintaining American-standard safety protocols. I limit my surgeries to ensure I am fresh and focused for your procedure.

The Financial Cost of Waiting (The 6-Month Trap)

There is a hidden cost to US insurance that nobody talks about: The Mandated Wait.

Most insurers require a 6-month “Supervised Weight Loss Program” before approval.

- Cost of Diet Food/Programs: ~$100/month ($600 total).

- Cost of Medications: Copays for blood pressure/diabetes meds for 6 months.

- Cost of Health: 6 more months of joint pain, fatigue, and metabolic damage.

With my self-pay protocol: We schedule you based on medical readiness, not bureaucracy. If your labs are clear and your heart is strong, we can often schedule you within 3-4 weeks. You start your new life half a year sooner.

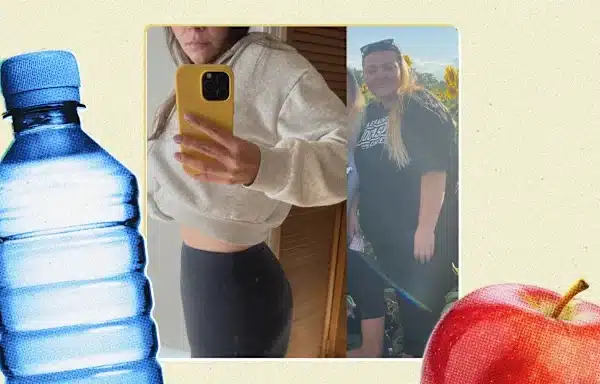

Real Patient Financial Case Study: “Brenda from Arizona”

Let’s look at a real comparison from a recent patient, Brenda.

Option A: Brenda’s BCBS Plan (Arizona)

- Deductible: $5,000

- Co-pay: $500 per hospital night (2 nights = $1,000)

- Required Psych Eval: $350 (Out of pocket)

- Wait Time: 6 Months

- TOTAL ESTIMATED COST: $6,350 + 6 Months

Option B: Dr. Gabriela (Tijuana)

- All-Inclusive Package: $5,800

- Flight (Phoenix to San Diego): $250

- Wait Time: 3 Weeks

- TOTAL ACTUAL COST: $6,050 + 3 Weeks

Brenda chose Option B. She saved $300, but more importantly, she saved 5 months of waiting. She was already at her goal weight by the time her insurance would have approved her.

Financing: You Don’t Need $6,000 Cash Today

Understanding that a lump sum can be difficult, my office works with specialized medical financing partners (like United Medical Credit).

Most patients qualify for monthly payments that are often lower than their monthly grocery bill.

- Instead of spending $400/month on fast food, snacks, and medications, you invest that same amount into a surgery that eliminates the need for them.

Conclusion: Do the Math, Then Pack Your Bags

Don’t let the word “Insurance” fool you into thinking it’s the best financial option. Look at your “Summary of Benefits.” Check your deductible.

If you are going to spend $5,000+ anyway, why not spend it on a VIP experience with a Master Surgeon who treats you like family, rather than a case number?